August 13th, 2012

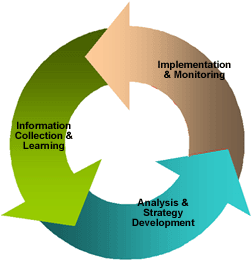

Part of being a Prosperous Investor means monitoring your market to understand what stage of the cycle you are in.

This is YOUR investment; YOUR business, so there are certain steps you need to take to ensure success (and not failure!) One thing you must do is track rental rates on a monthly basis and always ensure that you are getting your full increases. Work with your financial institutions to help you look at ways to improve your cash flow position.

Most banks won’t drop the monthly payment of your mortgage if the interest rate goes down. What happens is more money is paying down the principle with less going to interest. This way reducing your term of your mortgage faster, for example, 30 years would become 28 years.

If cash flow is important see the bank and have them drop the payment to reflect the current rate. If you’ve been paying a mortgage for 5 – 10 years you may want to extend the amortization to a full term reducing your mortgage.

Again, if cash flow is an issue it may make more sense for you to pay a penalty to increase your cash flow. I’ve had clients in this situation and losing $200.00 per month on their property. By switching the mortgage and paying the penalty they were put back into a positive position of over $175 per month.

It’s all about Cash Flow. Treat your real estate as a business and adapt to ensure your business is profitable.

If you have questions on this, or anything related to your real estate investing business, please don’t hesitate to get in touch with me.

Sincerely,

Michael Ponte, President & Founder

Prosperity Real Estate Investments

Phone: 604-882-6901

Tags: adapting to the market, real estate investing

Posted in real estate investing | No Comments »